You’ve likely witnessed processions of crushed vehicles being hauled together on trucks. You could undoubtedly identify those cars as being totaled, but it’s not always clear when a car isn’t worth repairing. After a particularly bad wreck, your heart may sink upon realizing the damage is so substantial it may not be fixable or worth repairing. While an insurance provider will likely provide their own opinion, it’s good to know for yourself if your car is totaled. When your vehicle is declared a total loss, understanding how to calculate your car accident compensation amount in Florida becomes essential for getting fair value.

You’ve likely witnessed processions of crushed vehicles being hauled together on trucks. You could undoubtedly identify those cars as being totaled, but it’s not always clear when a car isn’t worth repairing. After a particularly bad wreck, your heart may sink upon realizing the damage is so substantial it may not be fixable or worth repairing. While an insurance provider will likely provide their own opinion, it’s good to know for yourself if your car is totaled. When your vehicle is declared a total loss, understanding how to calculate your car accident compensation amount in Florida becomes essential for getting fair value.

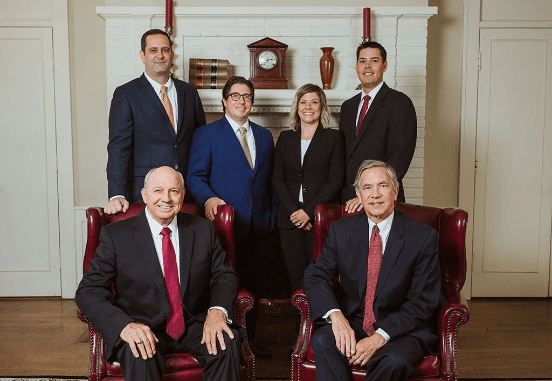

You and your insurance provider may dispute the amount that they should pay for vehicle damages. Your best course of action may be to consult an experienced attorney before accepting any offer from the insurance company. The knowledgeable personal injury attorneys at Wooten, Kimbrough, Damaso, and Dennis, P.A. have the experience to help you secure a fair settlement and the skills to negotiate with the insurance company on your behalf.

How the State of Florida Defines a Totaled Car

After an accident, a vehicle may be declared a total loss under Florida law if the cost of repairing the damage exceeds 80% of the vehicle’s fair market value, or actual cash value (ACV). A damaged vehicle’s ACV is equal to its fair market value before the accident, which is equal to its replacement cost minus depreciation.

If your car meets any of the following conditions, it’s likely to be deemed a total loss: the car won’t start, parts of the car are bent, components obstruct the driver’s view, or fluids are leaking.

Common Signs Your Car May Be Totaled

When your insurance provider determines that it would be more expensive to fix your car after an accident than to replace it, they will decline to fix the vehicle and will instead pay you the value of the vehicle in full. You can then use this money to purchase a replacement automobile.

Following an accident, an insurance adjuster will likely consider your car totaled if any of the following apply to it:

- Your car won’t start or is leaking fluids. Fluid leaks frequently require expensive repair, which many insurance companies are unwilling to cover.

- Your car is an older model with significant frame damage. The costs to rebuild the car’s frame and repaint it wouldn’t be worthwhile if your car is more than five years old and the frame has sustained significant damage.

- Your car is more than fifteen years old. Even if mechanics can repair it, a 20-year-old car likely isn’t worth much money unless it’s an antique or classic car.

- Your car has a high number of miles. The value of your car decreases as the mileage increases.

In all these scenarios, the insurance adjuster is measuring the car’s value against the cost of repairs, and numerous factors can impact the value of a car. However, that doesn’t mean the insurance company’s offer is fair. Protect yourself and ensure you receive a fair offer by partnering with our experienced car accident lawyer in Orlando, FL.

Experienced Car Accident Lawyers Can Help You Negotiate a Fair Offer

Dealing with auto insurance after an accident and a totaled vehicle is often very stressful. Your insurance provider may declare your car a total loss if the damage sustained in an accident isn’t worth the cost to properly repair it. However, various factors may make your car worth more than the insurance company’s actual cash value settlement offer. It is crucial to consult a knowledgeable car accident lawyer before accepting an unfair offer from an insurance provider.

At Wooten, Kimbrough, Damaso, and Dennis, P.A., our team includes skilled trial lawyers experienced in securing fair settlements for their clients. For over 50 years, we have protected Floridians against negligence and unjust insurance companies. By retaining our services, you can be confident that you will receive superior legal assistance. Call (407) 843-7060 or message us using our contact form to schedule a consultation with one of our qualified attorneys.

FAQ

How does Florida law determine if a car is totaled after an accident?

In Florida, a car is considered totaled if the cost to repair the vehicle exceeds 80% of its fair market value, also known as the actual cash value (ACV). This means that if the repair costs are higher than 80% of what the car was worth before the accident, the insurance company may declare it a total loss and offer compensation based on the vehicle’s pre-accident value.

What are common signs that a car is considered totaled by an insurance company?

Common signs your car may be considered totaled include significant frame damage, fluid leaks, or the inability to start after an accident. Older vehicles, particularly those more than 15 years old or with high mileage, are also more likely to be declared a total loss. In these cases, the cost of repairs is often deemed too high compared to the car’s current value.

What should I do if I disagree with my insurance company’s offer after my car is totaled?

If you disagree with your insurance company’s offer after your car is totaled, it’s essential to consult with an experienced car accident attorney. Insurance companies may undervalue your car’s worth, and a skilled lawyer can help negotiate a fair settlement based on the actual value of your vehicle. This ensures you aren’t left with an unfair offer.

Can I negotiate a better settlement if my car is totaled in Florida?

Yes, you can negotiate a better settlement if your car is totaled in Florida. Various factors, such as the condition of your car, its mileage, and any recent upgrades, may increase its value beyond the insurance company’s initial offer. Partnering with an experienced car accident lawyer can help you present a stronger case for a higher payout.

What factors impact the value of my totaled car in a Florida insurance claim?

Several factors impact the value of a totaled car in a Florida insurance claim, including the car’s age, mileage, and condition before the accident. Insurance companies calculate the actual cash value (ACV) by factoring in depreciation and the vehicle’s market value. If your car is older or has significant mileage, it may be valued lower, but recent repairs or upgrades may increase its worth.

Legally Written and Reviewed by a Managing Partner

Wooten, Kimbrough, Damaso, and Dennis, P.A.

Our content is written and reviewed by our founding attorneys Butch Wooten, Orman Kimbrough, Mike Damaso, and Tom Dennis. Helping the injured since 1966, they’ve successfully handled thousands of personal injury cases across Florida. Whether you’re a Florida resident or an out-of-state visitor injured in Florida, we’re dedicated to providing clear and reliable information to help you navigate your legal options confidently.