A car accident can throw a wrench into your day, leaving you injured and unsure of your next steps. As one of the few no-fault states in the country, Florida’s insurance system offers coverage for medical costs regardless of who was responsible for the collision. However, these insurance laws can be complex, and your insurance may not cover all of the costs associated with your recovery. If you have been injured in an accident, an experienced attorney can explain your rights and legal options and help you fight for the compensation you deserve.

A car accident can throw a wrench into your day, leaving you injured and unsure of your next steps. As one of the few no-fault states in the country, Florida’s insurance system offers coverage for medical costs regardless of who was responsible for the collision. However, these insurance laws can be complex, and your insurance may not cover all of the costs associated with your recovery. If you have been injured in an accident, an experienced attorney can explain your rights and legal options and help you fight for the compensation you deserve.

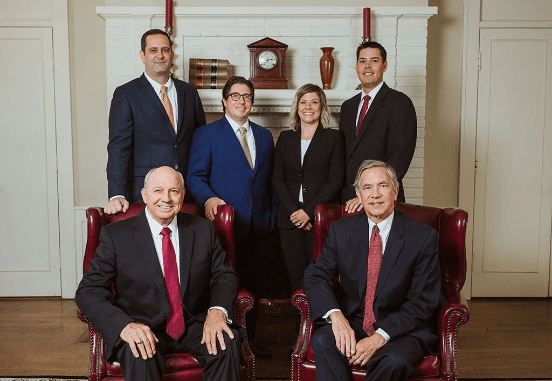

The skilled car accident attorneys at Wooten, Kimbrough, Damaso, and Dennis, P.A. are dedicated to helping their clients fight for their rights and interests. We can help you navigate Florida’s complex legal system and handle every detail of your claim so you can focus on your healing and recovery. When you choose us, you can trust our attorneys to fight tirelessly for the maximum compensation for your injuries and other losses.

Florida’s No-Fault Insurance Laws Explained

Under Florida law, drivers must carry no less than $10,000 in Personal Injury Protection (PIP) insurance. If you are injured in a car accident, you may file a claim for compensation with your insurance company regardless of your level of fault. This system is in place to help accident victims recover compensation more efficiently following an accident. However, there are several limits on how much accident victims can recover through a no-fault claim, including the following:

- 80% of medical expenses related to the car accident

- 60% of lost wages due to the accident and your subsequent injuries

- $5,000 in death benefits

If you plan to file a no-fault claim, it is essential to act quickly to recover compensation. Florida abides by a 14-day rule, meaning you must file your claim within 14 days of the accident to be eligible to collect damages. Your attorney can work quickly to investigate your case and file the necessary paperwork before this critical deadline passes.

Can I Still File a Lawsuit Under Florida’s No-Fault System?

If your injuries are serious, you may have grounds to step outside of Florida’s no-fault system to file a lawsuit against the negligent party. Florida uses the following criteria to define serious injuries:

- Significant and permanent loss of an essential bodily function

- Permanent injuries, scarring, or disfigurement

- Death

Through a personal injury lawsuit, you can pursue damages for the full extent of your medical expenses and lost wages instead of only a percentage of them. You may also be eligible to recover damages for your non-tangible losses, such as pain and suffering, emotional distress, or loss of enjoyment in life. Your attorney will work with you to evaluate the aftermath of your accident and the impact your injuries have on your life to determine and fight for the total value of your claim.

Speak to a Knowledgeable Car Accident Attorney at Wooten, Kimbrough, Damaso, and Dennis, P.A.

At Wooten, Kimbrough, Damaso, and Dennis, P.A., our attorneys are committed to helping our clients pursue damages for the full extent of the losses they have endured. We have over a century of combined experience securing favorable outcomes for our clients in Florida and are ready to apply our wealth of knowledge and skills to your unique case. Our attorneys will work with you to ensure you understand your rights and legal options and will guide you through every step of the legal process. When you entrust your case to us, we will do everything in our power to protect your rights and interests.

To learn more about how our skilled attorneys can help you, call us today at (407) 843-7060 or complete our contact form.

Legally Written and Reviewed by a Managing Partner

Wooten, Kimbrough, Damaso, and Dennis, P.A.

Our content is written and reviewed by our founding attorneys Butch Wooten, Orman Kimbrough, Mike Damaso, and Tom Dennis. Helping the injured since 1966, they’ve successfully handled thousands of personal injury cases across Florida. Whether you’re a Florida resident or an out-of-state visitor injured in Florida, we’re dedicated to providing clear and reliable information to help you navigate your legal options confidently.